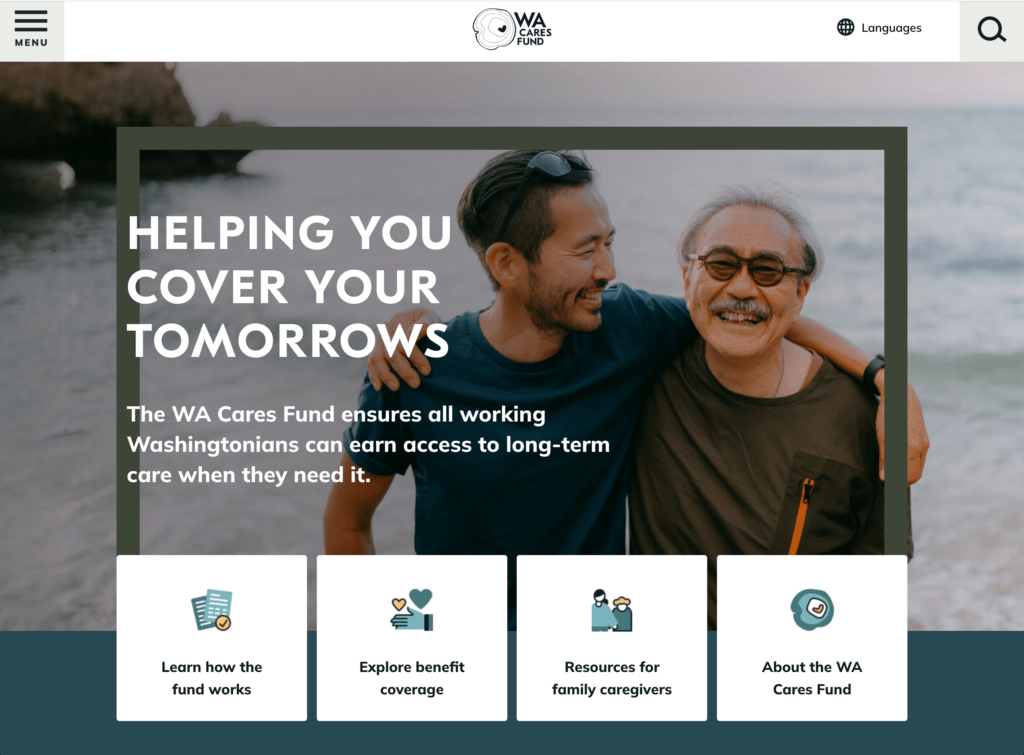

About WA Cares:

An affordable home care and long-term care benefit for working Washingtonians

Nobody plans to need long-term care, but at some point in our lives, 70% of Washingtonians will need it. Before that happens, there are some things you should know about WA Cares to help you get care at home.

What you might not know about WA Cares is that it covers costs for things like medical equipment, home care, and support with daily living. WA Cares will also pay our family members to help with cooking, cleaning, and grocery shopping.

WA Cares makes it possible for all Washingtonians to get the long-term care we need, when we need it.

About WA Cares – Cost

- WA Cares Benefits – up to $36,500 – start in 2026 and increase with inflation over time.

- The great thing about WA Cares is that we are automatically enrolled. A small amount ($0.58 per $100) will be deducted by our employer starting July 1, 2023.

- WA Cares provides peace of mind at a fraction of the cost of private long-term care insurance. Opting out of WA Cares means taking a chance on private insurance with ballooning premiums and no coverage guarantees.

- Most long-term care insurance companies increase premiums for women. WA Cares never will.

- One unique thing about WA Cares is that it has no penalties for missed payment due to unemployment or extended leave.

About WA Cares – Eligibility

- An important thing about WA Cares is that it will never deny care for pre-existing conditions. No exceptions. Most private insurance companies reject those with pre-existing conditions and won’t provide coverage. That’s millions of Washington adults under the age of 65 who would have nowhere to turn without WA Cares.

- Something else you might not know about WA Cares is that it has no daily spending limits. So if our private insurance or Medicare deny our care, WA Cares will still be there for us and our loved ones.

About WA Cares – Flexibility

- WA Cares is not just for seniors. This is a common misconception about WA Cares. Right now, 40% of those needing long-term care are under 65. WA Cares covers all working Washingtonians, however old we are.

- It can be scary to think about leaving our homes for a nursing home or other facility. The unique thing about WA Cares is it gives us the choice to stay at home and pay a family member or health aide to care for us. Private care insurance doesn’t always do that.

- We only contribute to the WA Cares Fund when we’re working – once we retire, our payments end and our coverage continues.

- WA Cares covers both home care and residential facility stays. With WA Cares, we have the choice to stay at home for care and pay a family member or long-term aide. Health insurance, disability insurance, workers compensation, and Medicare do not cover home care or nursing homes.

- Washington is the first state in the nation to create a public long-term care benefit. Now, other states like California and New York are following our lead. This is paving the way for making WA Cares benefits portable.

- New policy changes include coverage for near-retirees.

About WA Cares – Timeline of Legislation

2022

⌾

Legislature passes reforms to improve program and address coverage gaps.

2023

⌾

July: Workers begin contributing.

2026

⌾

July: Benefits become available for qualified, eligible individuals.

Up until now, working Washingtonians had very few long-term care options. Either care is too expensive, or it’s not accessible. The WA Cares Fund is a state solution to provide working Washingtonians with affordable long-term care.

About WA Cares – What It Covers

Home Care

Family Caregiving

Medical Equipment

Home Modifications

Residential Facilities

About WA Cares – How The WA Cares Fund Works

Total Benefits

| 2026 | $36,500 |

| 2030 | $40,289 |

| 2035 | $45,584 |

| 2040 | $51,574 |

| 2045 | $58,351 |

| 2050 | $66,019 |

87% of Washington adults between the ages of 20-64 are on track to receive WA Cares Fund benefits.

In ten years, more than 3 million Washington workers will be fully vested in WA Cares. We will have $36,500 for care when we need it. This benefit amount grows with inflation.

A great thing about WA Cares Fund is that the premiums are small – just $0.58 per $100 for Washington workers. Workers will automatically begin paying into the WA Cares Fund in July 2023 through pre-tax payroll deductions.

After contributing to WA Cares for three years, we will be able to access benefits if we experience a disabling event. Things like a serious car crash or stroke.

About WA Cares – 3 Flexible Vesting Options

By working an average of 10 hours per week, Washingtonians can access WA Cares Fund benefits 3 different ways when we need them:

Standard Vesting

We fully vest WA Cares Fund benefits after contributing for 10 years or more. Then, we have lifetime access to WA Cares benefits anytime we need them.

Emergency Vesting

After a disabling event like an accident or heart attack, we can access full WA Cares emergency benefits as soon as 2026. We only need to have contributed to the fund for three of the last six years.

Partial Vesting

If we stop working before 2033, we can access prorated WA Cares benefits.* For example, someone retiring in 2027 can access 40% of the benefit amount.

*Available to people in Washington born before 1/1/1968 who work an average of 10 hours/week and contribute for one year or more.

“I was partially paralyzed in a routine medical procedure.

– Dani, Asotin WA

Like most families, we don’t have enough to pay for a home care aide if I ever need one. Now, thanks to WA Cares, we have more options.

We both put in a little from our paychecks now, and WA Cares will pay for a home care aide when we need one.

So Sam can keep working, knowing I’m well cared for at home.”

We Care For WA Cares Coalition Members

Watch Stories About WA Cares Benefits

Hear from Washingtonians like Christina and learn about how WA Cares benefits will help us meet our long-term care needs.