WA Cares Makes Sure Everyone Can Get Long Term Care At Home

Wondering how much the WA long term care tax (also called WA Cares) will cost?

It all depends on how much your job pays.

First, it’s important you know that WA Cares benefits are just for Washington workers. The WA Cares Fund is there for every worker, whether you’re a permanent full time employee or a part-time gig worker. 70% of us will wind up needing long-term care at some point in our lives. Things like help with meals, chores, and daily tasks. With benefits from the WA long term care tax, working Washingtonians will now have access to money to pay for affordable long-term care.

With WA Cares, you’ll build valuable care benefits to help you when you need it. Whether you will need help recovering from a car accident, undergoing chemotherapy, or healing from a workplace injury, you’ll have the support you need. Learn more about the WA Cares Fund.

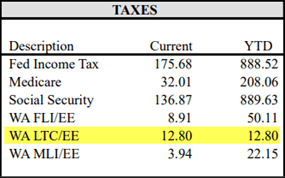

WA Cares is paid for by the “WA long term care tax,” that shows up automatically on your paycheck. You may see it listed as “WA LTC/EE” or “WAP” on your pay stub.

The WA Cares long term care tax is pretty small – just $0.58 per every $100 earned. It’s scaled so people with lower incomes pay less than people making six figures.

So how much will the “average” Washington worker pay with the WA long term care tax? Let’s look at an example.

“Joe” is a 50 year old construction worker. Joe’s company pays him $5,000 a month, or $60,000 a year (that’s about the median income here in Washington state).

Joe’s WA Cares benefits will likely be worth $55,539 in 2043 – that’s a 1,100% return!

Starting July 1st, Joe’s pay stub will show $29 per month deducted from his paycheck for a total of $348 per year.

If Joe stops working in 2038, he will have put in a total of $5,220.

When Joe goes to use his WA Cares benefits in 2043, they’ll likely be worth $55,539. That’s a 1,000% return!

Joe’s WA Cares benefits will be available to him for the rest of his life. He can use them anytime for home care, medical equipment, or even home improvements.

Best of all, his benefits grow over time to match inflation.

Ready to calculate how much you’ll pay with the new WA long term care tax, and how much you’ll earn in benefits? Find out how WA Cares stacks up against private insurance or Medicaid for long term care costs. Try out our simple benefits calculator.

With WA Cares, we contribute only when we’re working, and are vested after contributing for 10 years. Even if we’re working part-time (as little as 10 hrs/week on average).

Our benefit is available whenever we need it, and grows with inflation. Learn more about WA Cares here.